There are different types of salary sacrifice which is also known as salary packaging. These are: Superannuation Packaging, Novated Lease, Rent, Home Loan and laptop or phone. However, to those who wanted to own a home a little easier way possible, here's how you can do it. http://bit.ly/lA4XZj

Showing posts with label interest rate. Show all posts

Showing posts with label interest rate. Show all posts

Thursday, September 20, 2012

Sunday, September 9, 2012

Genuine savings: Assuring Your Lender to Paying Your Home Loan

"A penny saved is a penny earned." –Benjamin Franklin

This kind of saving is not an ordinary money saving. A genuine saving is policy that has been re-introduced by lenders so that you can prove a minimum of five percent savings for over three months in order to qualify for a home loan.

For those who don’t get it that much, here is a brief, precise and basic information of what genuine savings is.

Genuine Savings Explained

So if you think you can buy your home by just slamming a slab of money to your lender, you better think again. Nowadays, not all cash deposits are acceptable for your home application when you deposit below 20% of the purchased price. Conversely, if you cannot prove that you can save a deposit, you should then consider applying for a no savings home loan which is available up to 95% of the property’s value. And yes, you will still need a deposit and it can come from just about any source. Now, you question why lenders are being so strict with this policy. The lenders have tightened their belts when it comes to this since the Global Financial Crises which results to the eliminated the full availability of home loans but will be available with a guarantor. There are other assets that might be considered as genuine savings. Some of this is term deposits, shares, and equity of the property that are held for three months. Moreover, gifts from parents, tax refunds, income bonuses, saved cash and a lot more never qualifies for a genuine saving.

Related searches

This kind of saving is not an ordinary money saving. A genuine saving is policy that has been re-introduced by lenders so that you can prove a minimum of five percent savings for over three months in order to qualify for a home loan.

For those who don’t get it that much, here is a brief, precise and basic information of what genuine savings is.

Genuine Savings Explained

So if you think you can buy your home by just slamming a slab of money to your lender, you better think again. Nowadays, not all cash deposits are acceptable for your home application when you deposit below 20% of the purchased price. Conversely, if you cannot prove that you can save a deposit, you should then consider applying for a no savings home loan which is available up to 95% of the property’s value. And yes, you will still need a deposit and it can come from just about any source. Now, you question why lenders are being so strict with this policy. The lenders have tightened their belts when it comes to this since the Global Financial Crises which results to the eliminated the full availability of home loans but will be available with a guarantor. There are other assets that might be considered as genuine savings. Some of this is term deposits, shares, and equity of the property that are held for three months. Moreover, gifts from parents, tax refunds, income bonuses, saved cash and a lot more never qualifies for a genuine saving.

Related searches

- 95% No Genuine Savings Home Loan: Can I Get a Mortgage With No Deposit of My Own?

- No Deposit Home Loans - Information You Need To Know

- First Home Buyer

- Australian Army Home Loan - Can I Get a Home Loan With No Savings Using HPAS and FHOG As My Deposit?

- The Keys to Saving Money on Your Electric Bills

Wednesday, September 5, 2012

Home Loan Credit Score—Why You Need A Good Score

A credit score can mean the difference between being denied or approved for credit. In addition it is a high or low interest rate. A score that can get you qualified for apartment rentals and/or utilities without being required for a deposit must be a good score.

A credit score is a numerical expression based on statistical analysis of a person’s credit files, to present the “creditworthiness” of that particular person and it is primarily based on credit report information typically sourced from credit bureaus according to Wikipedia.

What's My Credit Score and How Do I Raise It?

If you wanted to improve your credit score in order to qualify for a credit, you have to understand how to improve your credit history. So clear up your jargons and make the most of your credit card.

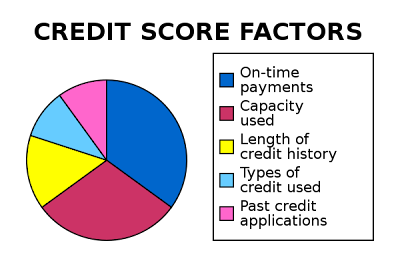

How Credit Score Is Calculated & How To Improve Your Credit History

There are some vague aspects of credit scoring formula. However, that is not the case, all you needed to know about is your credit score and knowing how to achieve the best of it.

How Can I Achieve The Best Credit Score?

Credit scoring is never limited to banks only. There are a lot of organizations that employ the like techniques such as mobile phone companies, insurance companies, government departments and even your landlords. So get things right by now and enjoy the privileges that a good score can give you.

More related blogs

A credit score is a numerical expression based on statistical analysis of a person’s credit files, to present the “creditworthiness” of that particular person and it is primarily based on credit report information typically sourced from credit bureaus according to Wikipedia.

What's My Credit Score and How Do I Raise It?

If you wanted to improve your credit score in order to qualify for a credit, you have to understand how to improve your credit history. So clear up your jargons and make the most of your credit card.

How Credit Score Is Calculated & How To Improve Your Credit History

There are some vague aspects of credit scoring formula. However, that is not the case, all you needed to know about is your credit score and knowing how to achieve the best of it.

How Can I Achieve The Best Credit Score?

Credit scoring is never limited to banks only. There are a lot of organizations that employ the like techniques such as mobile phone companies, insurance companies, government departments and even your landlords. So get things right by now and enjoy the privileges that a good score can give you.

More related blogs

- Credit Scoring Facts: Everything You Need To Know About Your Credit Score

- What Your Credit Score Costs You!

- Credit Score Ratings: Can you get free credit scores with your free credit report?

- Why You Must Have a Good Credit Score?

- The National Average Credit Score Range

Subscribe to:

Posts (Atom)