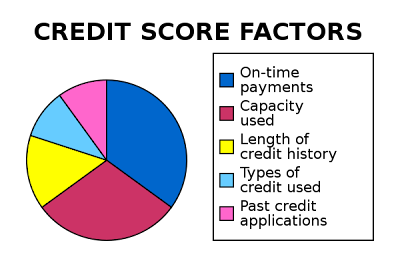

A credit score is a numerical expression based on statistical analysis of a person’s credit files, to present the “creditworthiness” of that particular person and it is primarily based on credit report information typically sourced from credit bureaus according to Wikipedia.

What's My Credit Score and How Do I Raise It?

If you wanted to improve your credit score in order to qualify for a credit, you have to understand how to improve your credit history. So clear up your jargons and make the most of your credit card.

How Credit Score Is Calculated & How To Improve Your Credit History

There are some vague aspects of credit scoring formula. However, that is not the case, all you needed to know about is your credit score and knowing how to achieve the best of it.

How Can I Achieve The Best Credit Score?

Credit scoring is never limited to banks only. There are a lot of organizations that employ the like techniques such as mobile phone companies, insurance companies, government departments and even your landlords. So get things right by now and enjoy the privileges that a good score can give you.

More related blogs

- Credit Scoring Facts: Everything You Need To Know About Your Credit Score

- What Your Credit Score Costs You!

- Credit Score Ratings: Can you get free credit scores with your free credit report?

- Why You Must Have a Good Credit Score?

- The National Average Credit Score Range

No comments:

Post a Comment